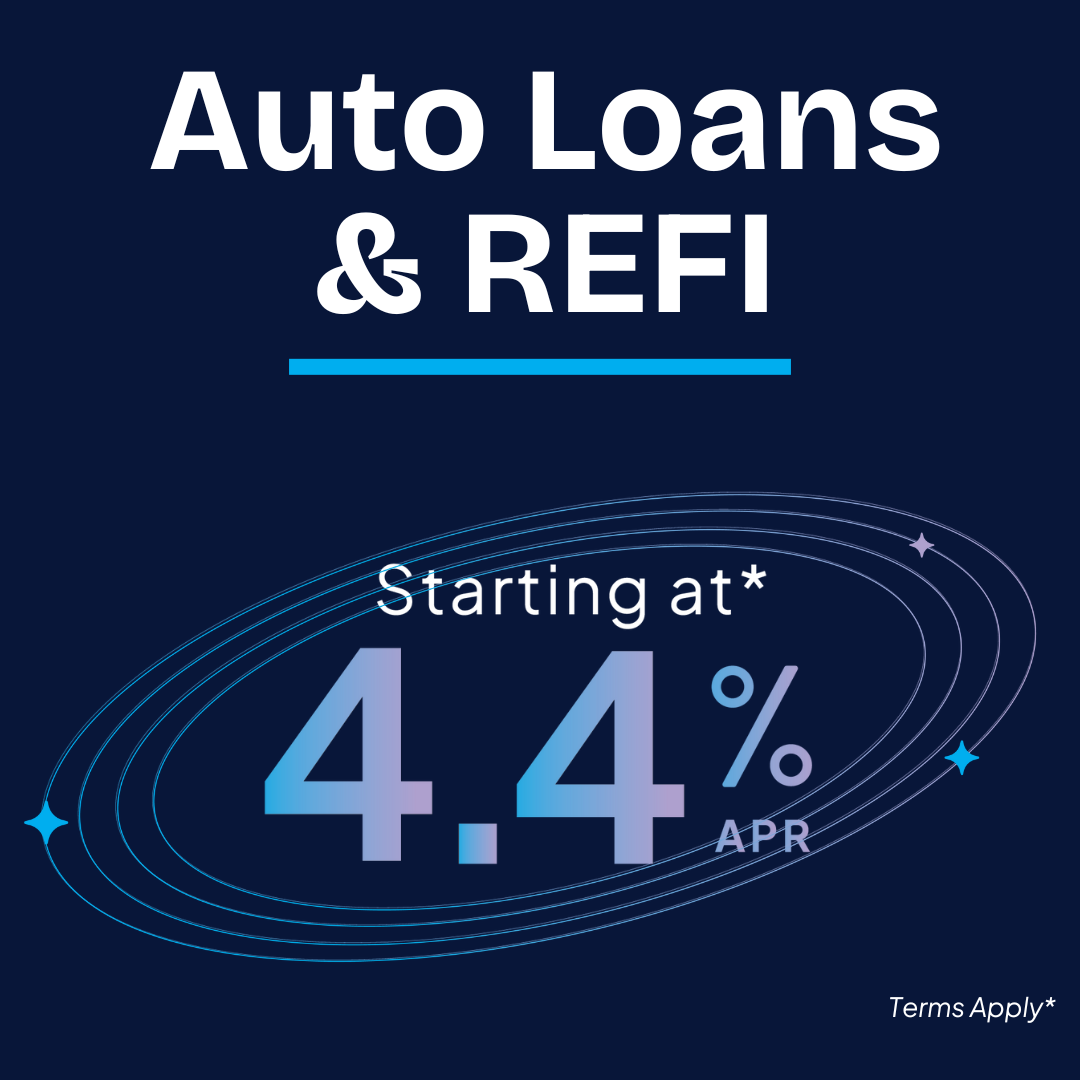

Orion has competitive, low-interest loan rates and offers.

NO PAYMENTS FOR 90 DAYS.**

We'll make it easier for you to get behind the wheel.

Convenient Financing Options

Thinking of buying a new car? Get pre-approved today. It's fast and convenient. You'll be driving off the lot in your new car in no time.

Refinance Your Current Loan with Orion

Refinancing your current car loan with Orion is easy, and could save you a lot in the long run.

HOW MUCH WILL MY PAYMENTS BE?

PROTECTIONS & COVERAGE

Orion partners with Allied Insurance to provide additional protections for your vehicle.

Extra Auto Protection (GAP)

If your vehicle is totaled or stolen, your primary insurance carrier will usually pay only the current market value of your vehicle. GAP helps bridge the gap between your loan balance and your insurance settlement, which could mean thousands of dollars of savings. Plus, you can receive an extra $1,000 to help buy your next vehicle.

Extended Auto Warranty (Major Mechanical)

This additional protection is designed for members who plan to keep their vehicle after the manufacturer's warranty has expired. Extended Auto Warranty protection helps pay for emergency roadside assistance, rental car reimbursement, and other expenses. Rest assured with no-risk plans that offer a 100% refund if not used.

Collateral Protection Insurance

Collateral Protection Insurance, or CPI, insures property held as collateral for loans made by lending institutions.

When a member takes out an auto, RV, or boat loan, etc., they sign an agreement to maintain dual-interest insurance, protecting both them and the credit union with comprehensive and collision coverage on the vehicle throughout the life of the loan. The member provides us with proof of insurance, which is verified by the credit union's CPI provider or a tracking company, Allied Solutions.

If a member does not provide proof of insurance or fails to purchase coverage, the credit union may choose to have CPI coverage placed on the loan to protect its interest from damage or loss.

When CPI is placed on the loan, the credit union passes the premium charge on to the member by adding the premium to the loan principal. The premium is paid back in installments by increasing the loan payment amount. If the member subsequently provides proof of insurance, a refund will be issued. A partial refund will be issued if there was a lapse in coverage. CPI policies are for one year. If a member does not obtain their own insurance, CPI can renew and bill annually.

Please note: CPI does not provide liability insurance to the member, nor does it meet the state-specific guidelines regarding acceptable insurance coverage.

Members can fax their policy information to 800-709-4818, or mail it to: Orion FCU, PO Box 1973, Carmel, IN 46082

For questions regarding CPI or proof of insurance verification, members can call Insurance Services at 1-800-653-8812, Monday-Friday, 8am-9pm, EST and Saturday, 9am-6pm EST. If you call into Orion’s Contact Center, select option #8 for Insurance Services.

Default amounts are hypothetical and may not apply to your individual situation. This calculator provides approximations for informational purposes only. Actual results will be provided by your lender and will likely vary depending on your eligibility and current market rates.

*Rates based on credit score, loan term, and age of vehicle.

**No payments for 90 days promotion is for loans for the purchase of autos or auto refinance from another institution. Conditions apply. Promotions may be canceled at any time without notice.